Access up to $500K through our Funding Marketplace.

Prequalify in minutes. No hard credit pulls. No confusion. Just real approvals and real results.

Excellent⭐⭐⭐⭐⭐

Rated 4.9/5 by clients

Is a Lack of Funding Putting Your Business at Risk?

Most business owners don’t struggle with ideas — they struggle with capital.

Without money, even great businesses can slow down, stall, or disappear. Ask yourself

are you facing any of these challenges right now?

You can’t buy the inventory or equipment your business needs.

You’re missing out on marketing opportunities that could grow revenue

You’re turning down jobs or clients because of limited cash flow

You can’t hire or retain the right team members

You’re relying on personal credit cards or savings to keep things going

You know your business could grow — you just don’t have the capital to make it happen

The Truth

Most business owners aren’t denied funding because their businesses can’t qualify —

they’re denied because they take the wrong approach.

Our process changes that by helping you access the right funding,

from the right lenders, in the right order.

Traditional Bank vs. Funding Marketplace

See the Difference for Yourself

Most business owners apply for funding the traditional way — through one bank or credit union — and end

up with limited options, smaller approvals, and wasted time.Our Funding Marketplace changes that by giving you

access to more lenders, more approvals, and a faster path to the money your business needs.

Traditional Bank

Limited to one lender’s products and approval criteria

Small loan amounts that often fall

short of your goals

One approval at a time — no chance

to combine offers

Higher interest rates and limited flexibility

Slow, outdated application process

No funding strategy or advisor support

Funding Marketplace

Access to 300+ lenders through one simple application

Soft credit pull — no impact on your score

Multiple approvals that can meet or exceed your funding goal

0% APR programs available for up to 18 months

Options for startups and credit-challenged business owners

Fast, modern approval process — often within days

The Entire Funding Marketplace All in One Place

Where Is Your Business?

Most business owners only have access to one bank and one type of loan.Our marketplace connects you to every major funding source — from personal term loans to business lines of credit, SBA loans, and 0% credit programs.No more guesswork. No more limits. Just the best options for your profile.

Funding Product

Amount

Access

Rates

Terms

0% Promo Credit Cards

Obtain multiple 0% credit cards to launch or grow your business. Available in business or personal name. Cashback and rewards options available.

$5k – $75k

7 – 10 Days

0% (12–15 Months), then 15.99% – 24.99%

Monthly payment ~2%–3% of balance

Business Line of Credit

Flexible capital when needed. Only pay interest on what you draw.

$5k – $200k

1 – 5 Days

8.99% – 29.99%

6 – 24 Months

Business Term Loan

Ideal for established businesses needing predictable monthly payments.

$20k – $500k

5 – 10 Days

11% – 25%

1 – 5 Years

Personal Term Loan

Used to pay down credit card balances, raise credit score, or inject capital into your business.

$5k – $45k

1 – 5 Days

8.99% – 29.99%

24 – 72 Months

Short-Term Business Loan

Fast funding for urgent expenses. Higher cost, but rapid turnaround.

$5k – $100k

24 – 72 Hours

15% – 35%

6 – 12 Months

We Guarantee the Best Funding Options Period.

Get hands-on guidance and real results — all backed by our Best Funding Guarantee.

When you work with CEO Capital Connection, you’re not just applying for funding — you’re partnering with a team that knows how to get real results.

Our Best Funding Guarantee means you’ll always have an expert advisor guiding you to the right funding sources, in the right order, to secure the maximum amount possible — with no wasted time, no credit damage, and no confusion.

Our Best Funding Guarantee Includes

Access Over 300 Lenders — One Simple Application

Compare multiple offers side by side without multiple credit pulls.

Funding Available in All 50 States

Get capital through our nationwide network of trusted lenders.

Reduce Your Monthly Costs and Save More Money

Move high-interest balances to new 0% APR accounts for up to 18 months.

Pre-Qualify Without Hurting Your Credit

Soft pull only. See your true options with zero impact on your score.

Startup-Friendly Funding Options

Even brand-new businesses can

qualify fast.

No-Doc & Low-Doc Programs Available

Get capital even if you don’t have full financials.

How It Works

Simple Process. Real Results.

Getting funded shouldn’t be complicated. Our process is built to help business owners

move fast, stay informed, and access the capital they actually need — without stress or confusion.

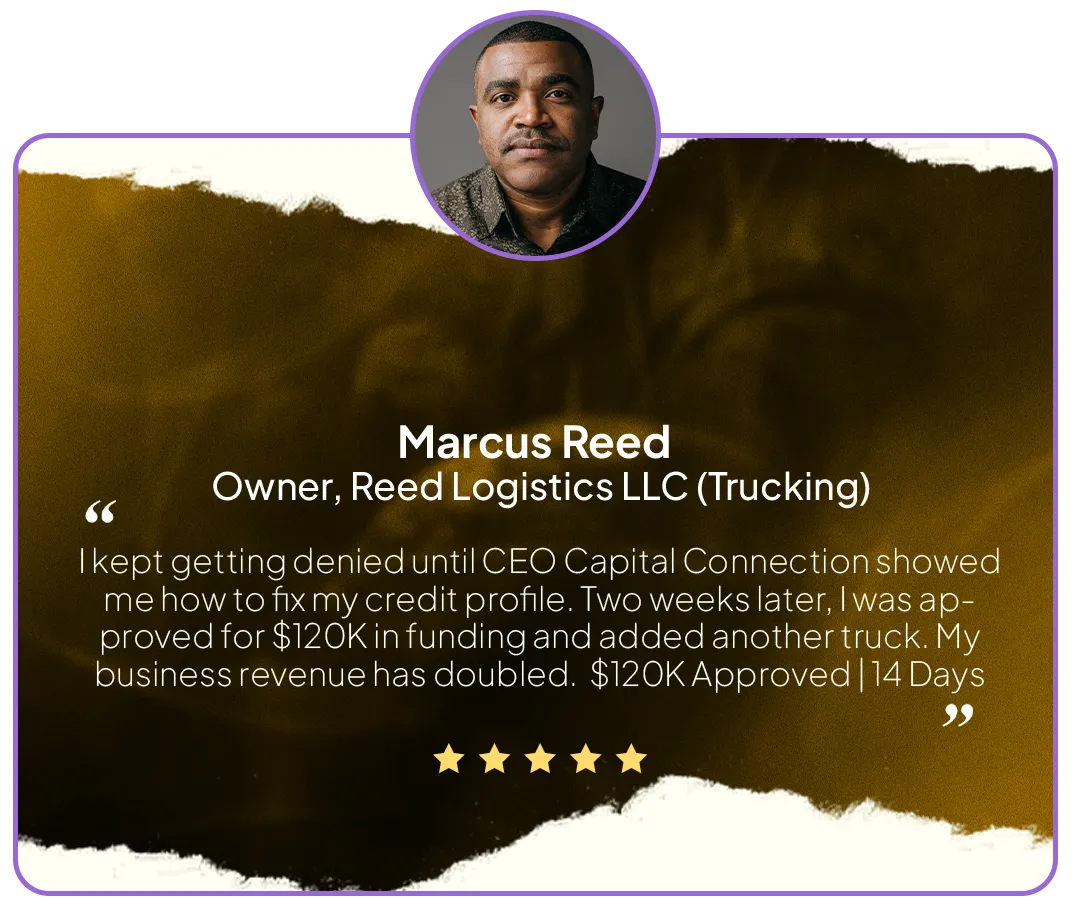

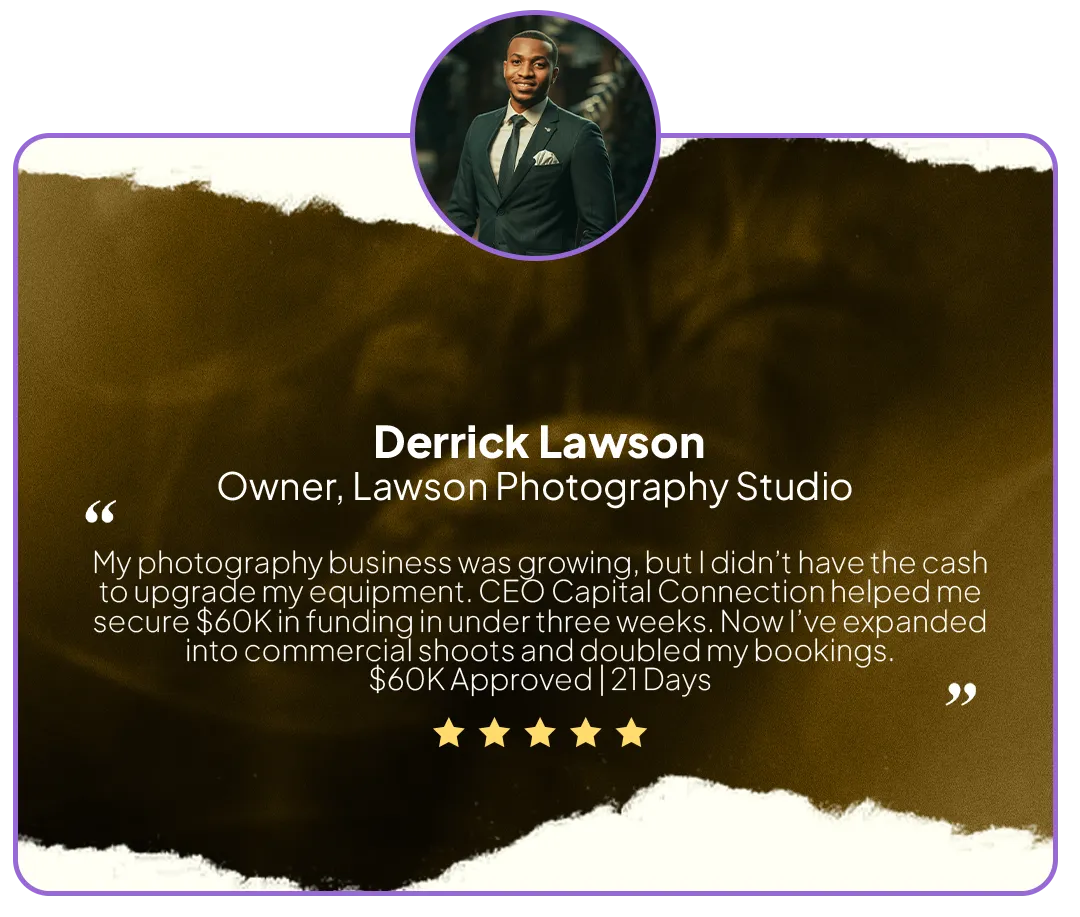

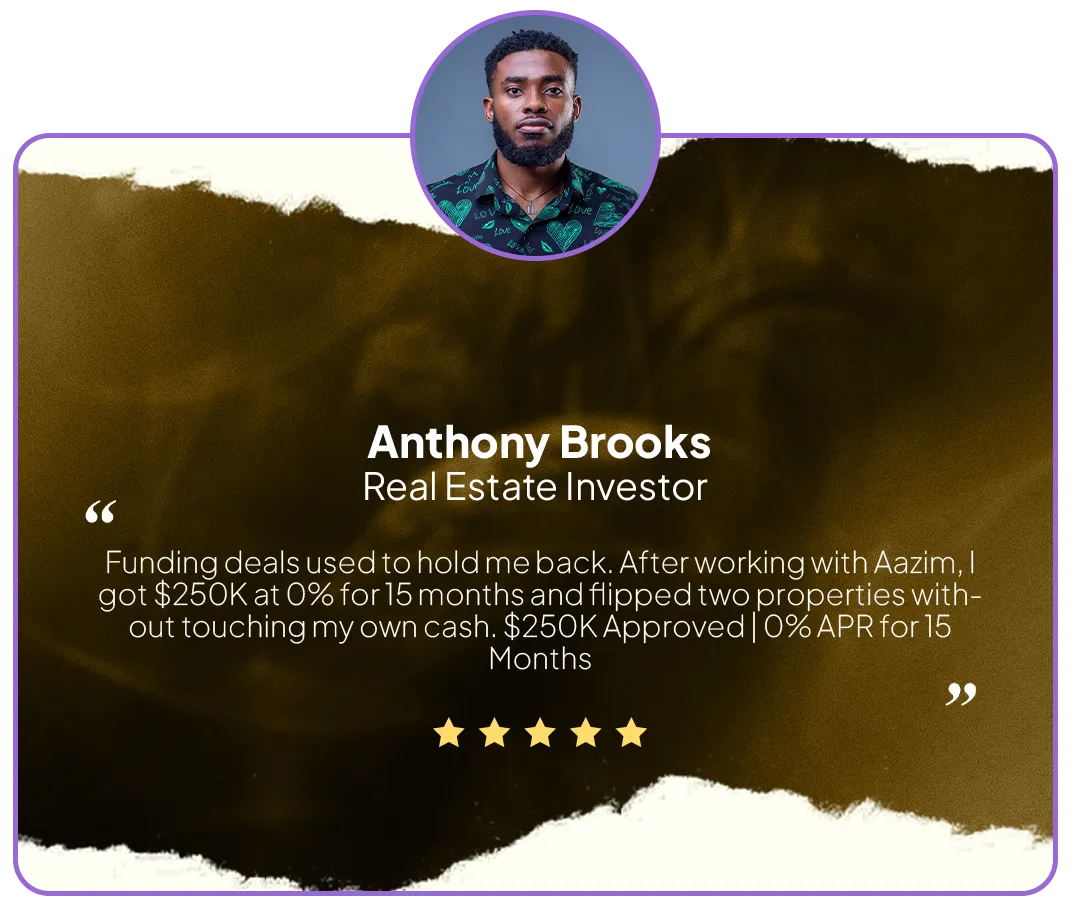

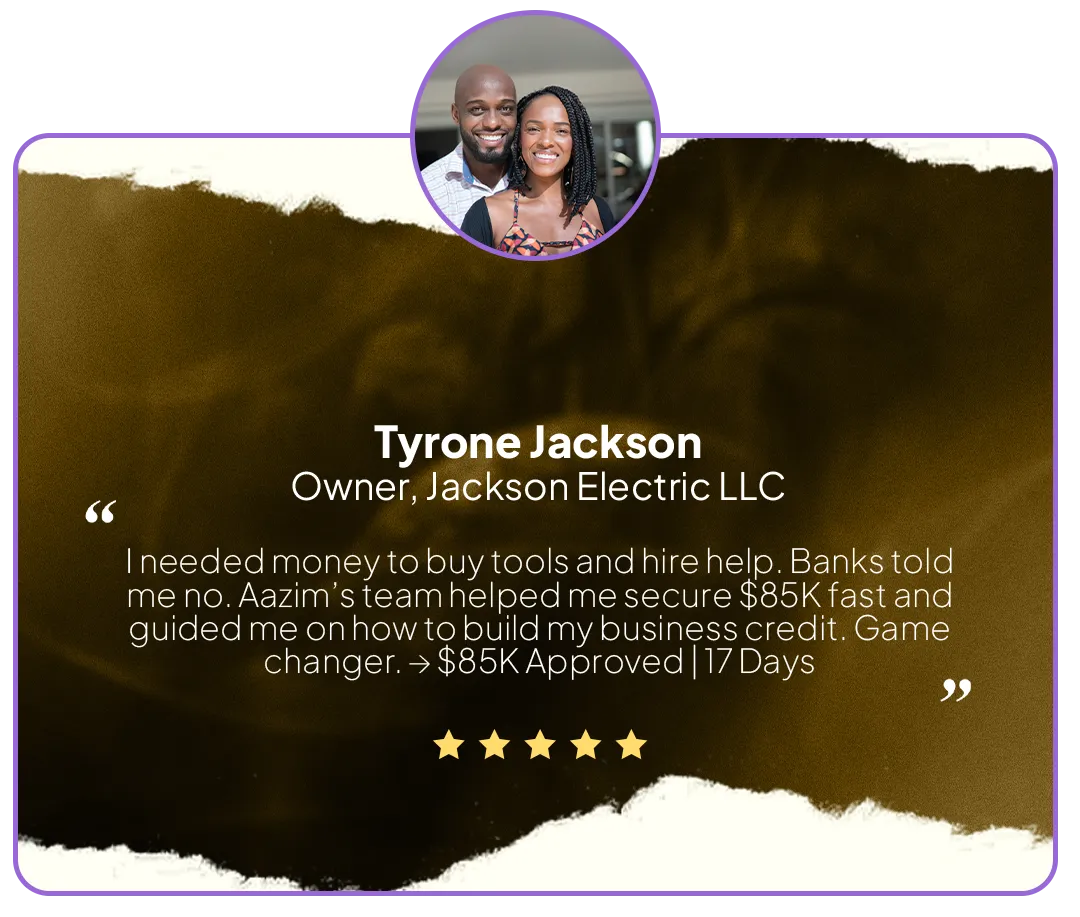

Real Business Owners. Real Funding. Real Results.

See How Our Clients Turned Approvals Into Growth

Our clients come from every industry trucking, real estate, photography, trades, and

more but they all share one goal: accessing the capital they need to grow.

Here are a few of their stories.

Your Funding, Secured and Guaranteed

You deserve more than just approval — You deserve the best funding available.

With CEO Capital Connection, you’re backed by a team that knows how to get results.

We combine advanced technology, expert advisors, and nationwide lender access to make sure

you always receive the best funding options possible — guaranteed.

Frequently Asked Questions

Will applying hurt my credit?

No. Our pre-qualification process uses a soft credit pull only, which means it has zero impact on your credit score.Hard inquiries only occur after you accept an offer and move forward with a lender.

How much funding can I get approved for?

Most clients secure between $50,000 and $500,000 in business funding, depending on personal credit, business revenue, and documentation.

Your funding advisor will show you multiple options and help you reach or even exceed your target amount.

How soon can I receive funding?

Once approved, funds can be deposited in as little as 3–7 business days — sometimes even faster depending on the lender and funding type.

What types of funding are available?

You’ll have access to the entire funding marketplace, including.

✅0% APR business and personal credit lines (12–18 months)

✅Business term loans

✅Business lines of credit

✅SBA loans

✅Merchant cash advances (MCA)

✅Startup funding options

Your funding advisor will match you with the best programs for your situation.

What if my credit isn’t perfect?

You can still qualify. We work with a wide range of lenders, including programs for credit-challenged and new business owners.

Even if you’re not ready yet, your advisor can help you improve your profile and get fundable fast.

Why should I work with CEO Capital Connection instead of going to my bank?

Traditional banks only offer a few loan products — and typically require near-perfect credit.

Our Funding Marketplace gives you access to 300+ lenders nationwide with just one application, helping you find the best options, faster.

What’s the catch?

There isn’t one.

You’ll get transparent guidance from a funding advisor, access to multiple lenders, and no pressure to accept any offer.

Our goal is to help you get the capital you need, at the best terms available.

What’s the next step?

It only takes 60 seconds to complete your pre-qualification form.Once you do, your funding advisor will contact you to discuss your funding goals and next steps.

No obligation. No hard credit pull. Just clarity and real options.

What are the interest rates like?

Rates vary based on credit, business age, and funding type. Our 0% APR credit lines are interest-free for up to 18 months, while term loans and MCAs depend on lender programs.

Your advisor will help you choose the best mix of funding options for your situation — not just the lowest rate.

What documents do I need to get started?

Most programs require:

✅Valid ID

✅Recent bank statements (last 3 months)

✅Proof of income or business revenue

✅Sometimes basic business documents (EIN, LLC, etc.)

Don’t worry — your funding advisor will guide you step-by-step so nothing is missed.

How long does my business need to be open to qualify?

We have programs for both new startups and established businesses.

Even if your business is only a few weeks old, there are options available through 0% APR and personal-based funding programs.

How flexible are repayment terms?

Repayment terms depend on the funding type.Term loans usually range from 2–5 years, while credit lines and 0% APR programs offer flexible usage and payback schedules.

Your advisor will help you select the structure that best fits your business cash flow.

Can I combine multiple approvals to reach my full funding goal?

Yes. This is one of the biggest advantages of working through our Funding Marketplace.If you need $250K, for example, and one lender approves you for $100K while another offers $150K, we can help you combine those approvals to meet or exceed your target — all with one seamless strategy.

Helping Small Business Owners Secure $50K–$500K in Funding — Fast.

Legal

Privacy Policy

Terms & Conditions